Number 335 July 18th, 2025 St. Louis

From Aloe to A-List: Aselle Botanics Blends Generational Wisdom with Skincare Innovation

In the competitive beauty industry, Aselle Botanics, based in St. Louis, distinguishes itself with its personal origins and ambitious vision. Founded by the mother-and-daughter duo Michelle and Abigail Hollis, the brand combines traditional natural remedies with innovative skincare science to offer high-quality, affordable luxury products.

Inspired by Michelle’s grandmother, “Big Momma Josie,” who swore by aloe vera for radiant skin, Aselle Botanics places the ingredient at the heart of every product. But this is more than a nod to tradition; Michelle and Abbey elevate their formulas with high-performance ingredients like hyaluronic acid, retinol, and niacinamide to meet modern skincare needs.

With support from Justine PETERSEN and funding through an SBA Microloan, the pair laid a solid foundation for growth, building an e-commerce platform, entering wholesale markets, and developing a strong advisory team through SCORE. Their three-year financial plan projects significant growth and a larger team in the years ahead.

Michelle’s background in tech, business, and customer service, paired with Abigail’s expertise as a community herbalist, makes for a dynamic partnership focused on serving mature women of color—and beyond.

Aselle Botanics is more than a skincare line. It’s a legacy, a celebration of women, and a movement redefining beauty through heritage, science, and intention.

Visit them at: asellebotanics.com

Success Story: Andrea and Jarred Smith – Turning Challenges into Triumph

Andrea and Jarred Smith, proud participants in the Access Home Cohort—a collaborative effort between U.S. Bank, R&R Church, and Justine PETERSEN’s Home Team—achieved their dream of homeownership in April 2025, closing on their new home in the City of St. Louis.

Their journey, however, took an unexpected turn when their home was struck by the devastating tornado that hit the city on May 16th. Despite the setback, Andrea and Jarred’s resilience and determination never wavered.

With the support of Will Jordan, JP’s Community Investment Manager, along with other dedicated partners like Christina Haffer, Megan Cron, and Robert Boyle, the Smiths navigated this hardship and are now firmly on the path to rebuilding and reclaiming their dream. Their story is a powerful reminder of what community, partnership, and perseverance can accomplish.

Congratulations to the Smiths—and thank you to everyone who helped make this win possible!

Upcoming Events

You’re Invited!

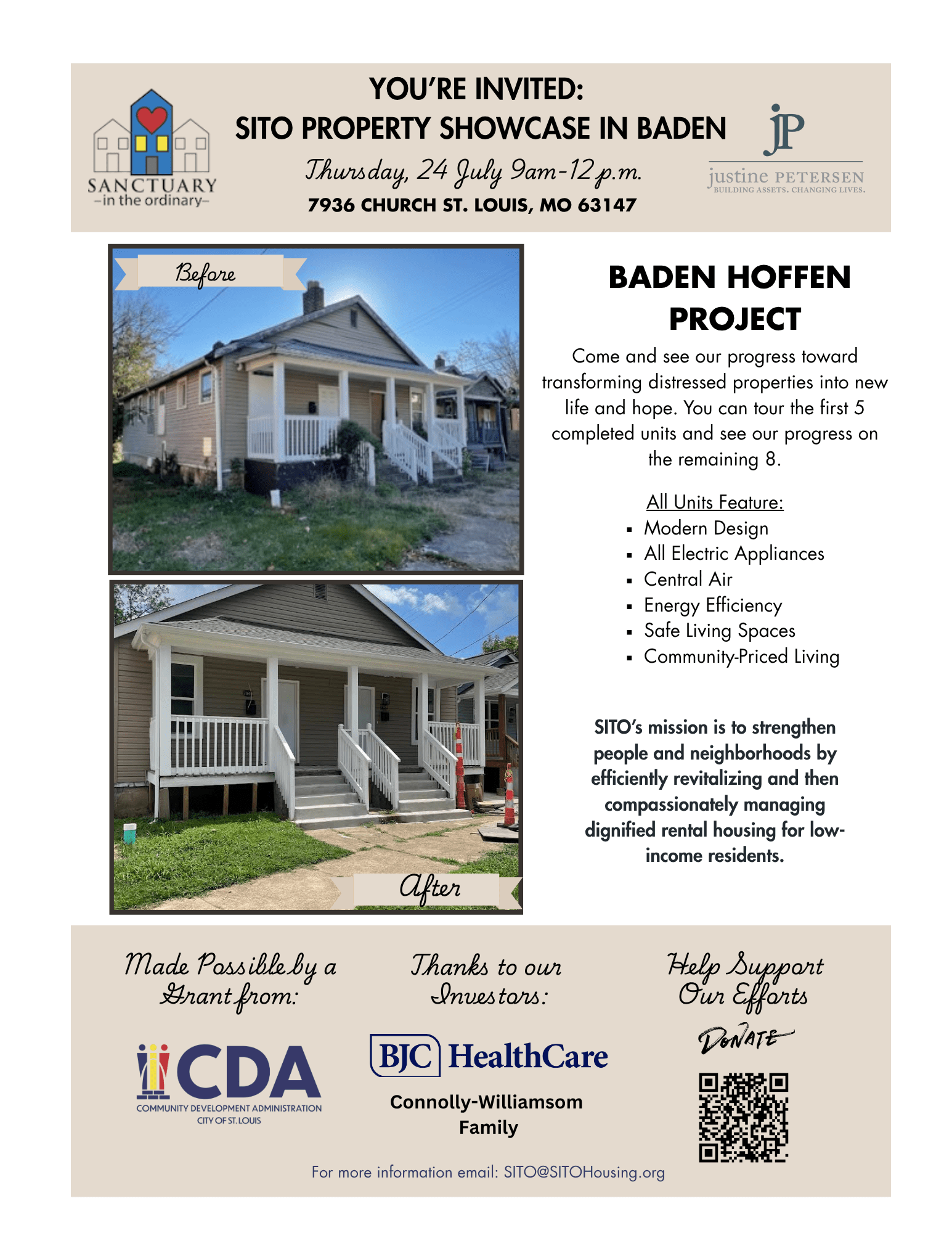

Join us for the Baden Hoffen Project Open House and see the exciting progress happening in the heart of North St. Louis!

Come tour the site, connect with community members, and learn how the Baden Hoffen Project aims to revitalize housing, empower residents, and build a stronger future for our neighborhoods.

Whether you’re a neighbor, local leader, or simply passionate about community development, we would love to see you there!

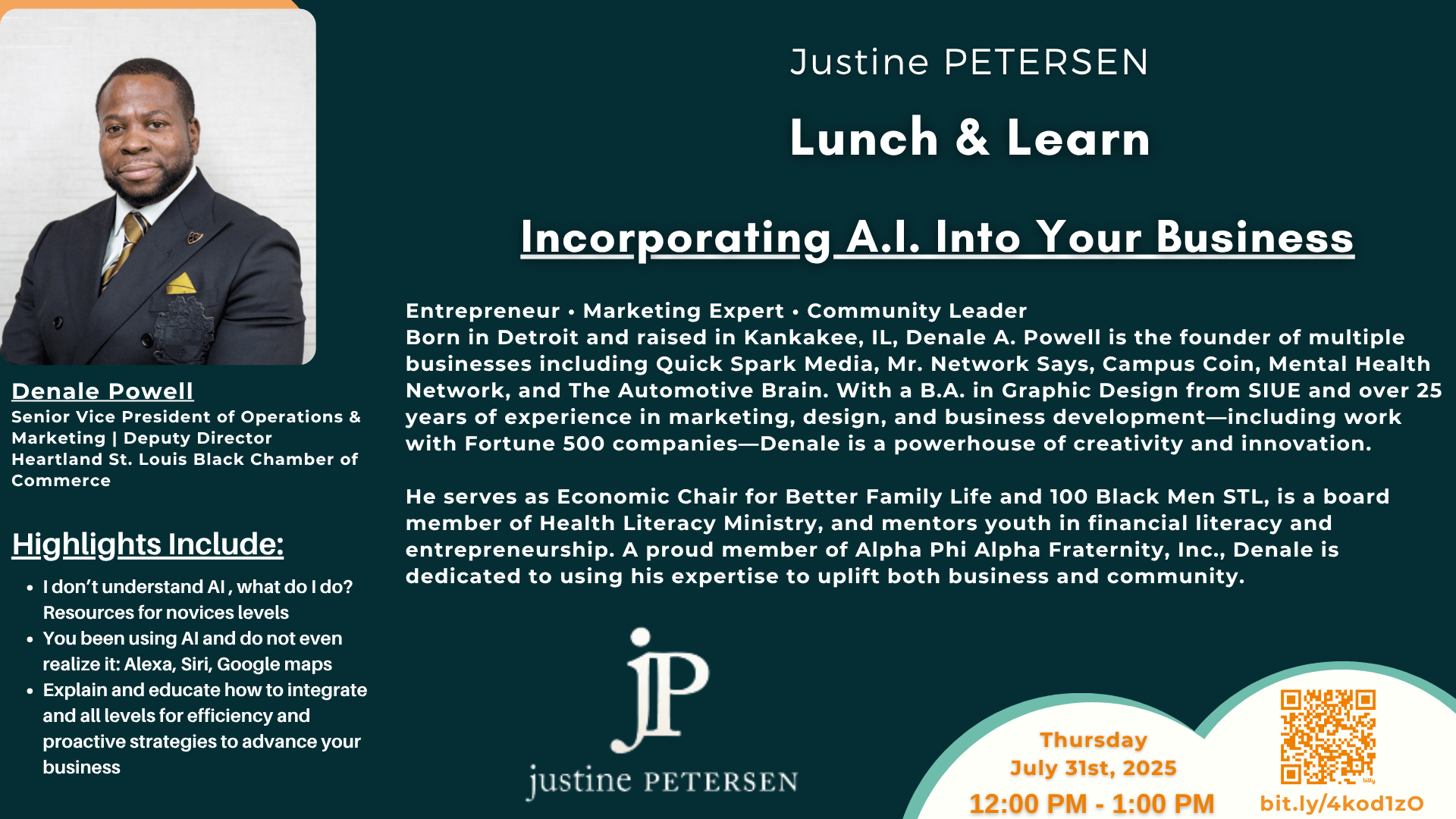

July 31st, 2025 – Lunch and Learn with Denale Powell

Justine PETERSEN Has Secured $4 million from Woodforest National Bank®

These funds are to provide affordable small business loans throughout Champaign County.

The low-cost funds are ideal for starting or expanding your business.

Learn more and apply at justinepetersen.org.

Woodforest National Bank® | Member FDIC

Making Your Way to a Wonderful Financial Future!

The My Credit Compass Program is a 12-month membership designed to enhance credit awareness for entrepreneurs and help manage their FICO® Score. Through your Experian® CreditCenterTM subscription, you’ll access a dashboard to view your FICO® Score anytime without impacting it.

How My Credit Compass and Save2Build work together to improve your credit and help you achieve financial freedom.

While My Credit Compass provides the knowledge and tools to monitor and manage your credit, Save2Build offers a practical way to improve your credit score. Through Justine PETERSEN’s CDFI, Great Rivers Community Capital, eligible clients receive a $300 credit builder loan placed into a locked savings account. Clients repay the loan over 12 months (around $26/month), with payments reported to two credit bureaus. This repayment activity directly supports the credit monitoring and management strategies taught in My Credit Compass.

After a year, clients have not only improved their credit score but also saved $300, which can be used for financial goals like opening a secured credit card, turning credit knowledge into real financial growth.

Benefits:

- Easy-to-use technology with personal support

- Confidence from financial coaching

- Plus, much more!

We’re excited to help you on your savings journey!

Start building your credit today with My Credit Compass and Save2Build!

Do You Follow Us On Social Media? Click the Icons Below to Get Started!!!

![]()

![]()

![]()

![]()

![]()

![]()

Copyright © |2020 Justine PETERSEN|, All rights reserved.

Want to change how you receive these emails?

You can update your preferences or unsubscribe from this list.

Justine Petersen Housing and Reinvestment Corporation · 1023 N Grand Blvd · Saint Louis, MO 63106-1641 · USA