Number 263 March 1, 2024 St. Louis

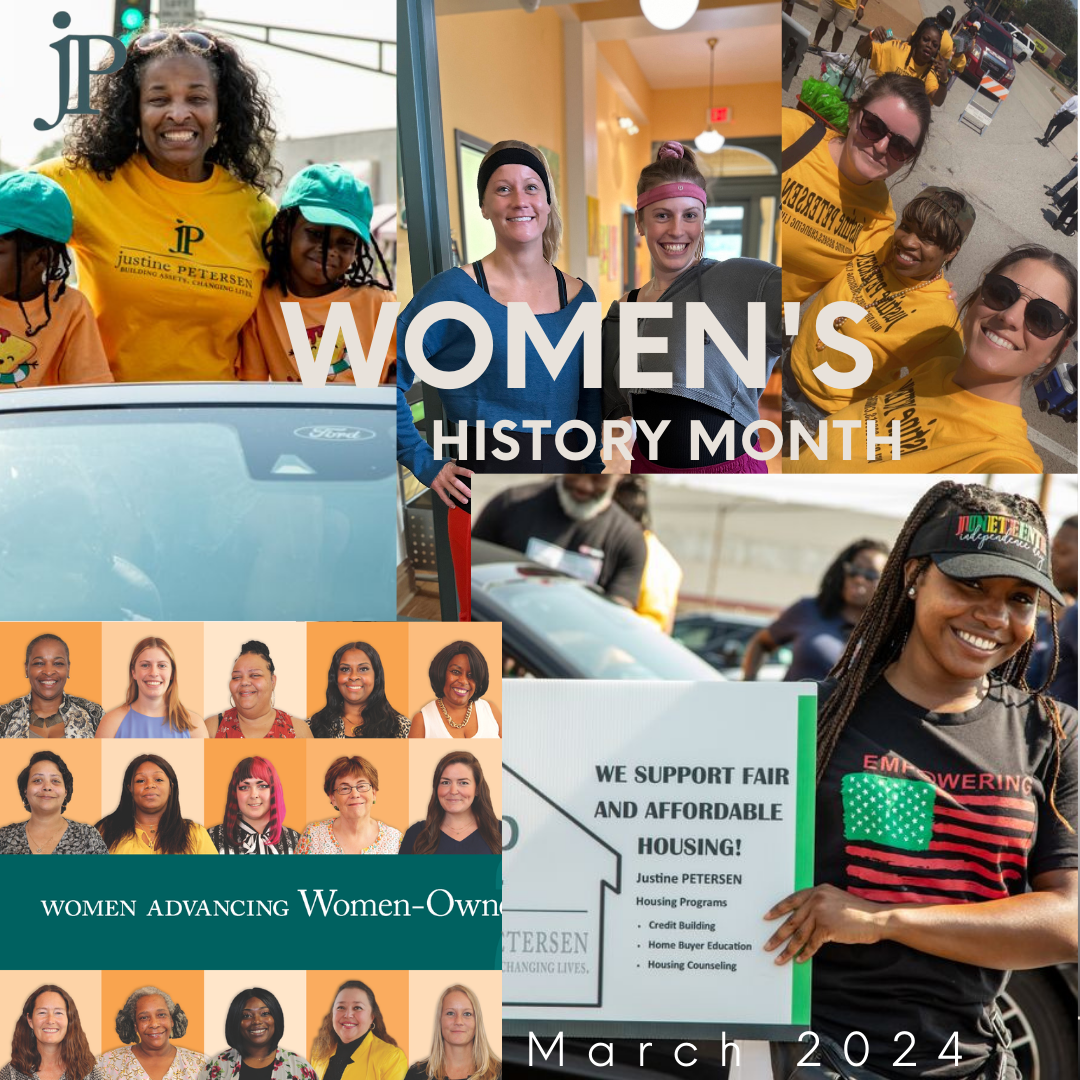

Celebrating Women During The Month of March!

As we mark the beginning of Women’s History Month, we extend our warmest wishes to all women. This month, we celebrate the remarkable achievements and invaluable contributions of women throughout history and within our institution. As firm believers in the advancement of women supporting other women, we are committed to fostering an environment where every woman can thrive and excel. Happy Women’s Month to all!

The Power of Budgeting and Planning in Credit-Building Programs: Why It Matters Most

By: Andrew Barnes

Courtesy of Investopedia

In a recent survey that we held, participants were asked to vote on what they believed mattered most in a credit-building program. The results were telling: a majority of respondents prioritized budgeting and planning over other aspects such as debt management and understanding credit scores. This outcome sheds light on the fundamental role that budgeting and planning play in individuals’ financial well-being and their journey towards building a healthy credit profile.

Budgeting and planning serve as the cornerstone of financial stability and responsible money management. At its core, budgeting involves creating a comprehensive plan that outlines income, expenses, and savings goals. It provides individuals with a clear understanding of their financial situation, allowing them to make informed decisions about how to allocate their resources effectively.

One of the primary reasons why budgeting and planning emerged as the most important aspect in the survey is its direct impact on controlling spending habits and avoiding unnecessary debt. By establishing a budget, individuals can identify areas where they may be overspending and adjust accordingly. This proactive approach not only helps in reducing debt but also prevents the accumulation of new debt, thus laying the groundwork for a solid credit foundation.

Moreover, budgeting and planning instill discipline and accountability in financial management. By adhering to a budget, individuals develop healthy financial habits such as prioritizing needs over wants, setting aside savings for emergencies, and planning for future expenses. These habits not only contribute to better financial decision-making but also demonstrate responsible behavior to potential creditors, thereby enhancing one’s creditworthiness.

Another crucial aspect of budgeting and planning is its role in fostering long-term financial resilience. By setting realistic goals and consistently monitoring progress, individuals can work towards achieving financial milestones such as paying off debt, saving for major purchases, or investing for the future. This forward-thinking approach not only promotes financial security but also provides a sense of empowerment and control over one’s financial destiny.

Furthermore, budgeting and planning serve as a proactive measure in managing financial setbacks and unexpected expenses. By having a contingency plan in place, individuals are better equipped to handle emergencies without resorting to high-interest borrowing or maxing out credit cards. This not only mitigates the risk of falling into debt but also safeguards one’s credit score from potential negative impacts.

In conclusion, the overwhelming preference for budgeting and planning in the survey underscores its significance in credit-building programs. By prioritizing budgeting and planning, individuals can gain control over their finances, reduce debt, and lay the groundwork for a strong credit profile. As the foundation of responsible financial management, budgeting and planning empower individuals to achieve their financial goals and build a brighter financial future.

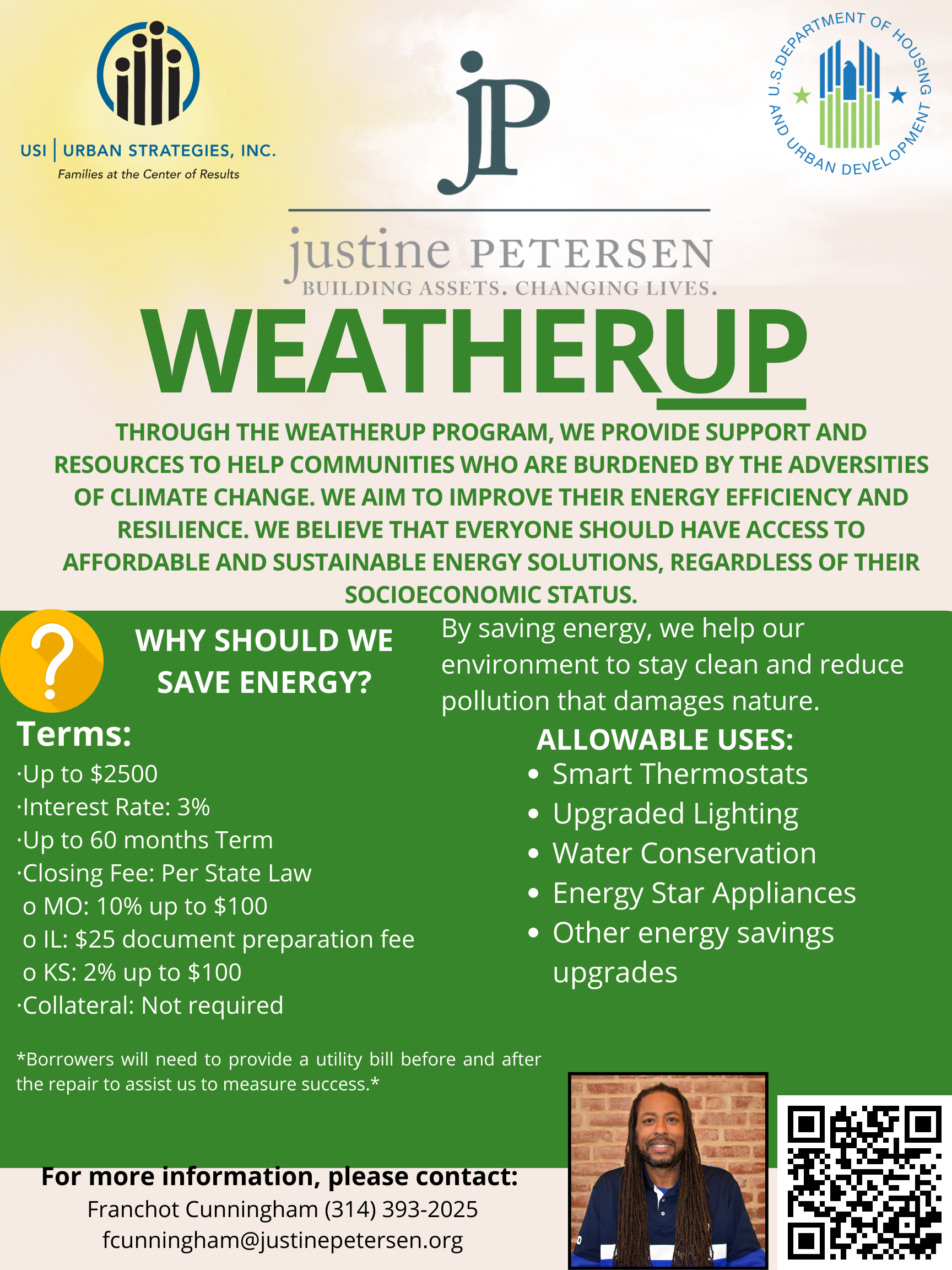

WeatherUp!

Feeling the heat and the chill? Our WeatherUp loan has you covered, keeping you comfortable in every temperature swing without busting your budget. Stay cozy in winter, cool in summer – all while saving big!

Embark on the journey into 2024 with our WeatherUp Loan program! Join us in transforming your home into an eco-friendly haven, contributing to a brighter future for everyone in your community. Discover more details below for a sustainable and impactful initiative.

What’s Your Why?

Get to Know Our Talented Staff and Their Stories on Our New Staff Biography

Meet Amy from our Resource Development team! She’s been an awesome asset to the organization, and we’re extremely fortunate to have her on board. Check out her story here!

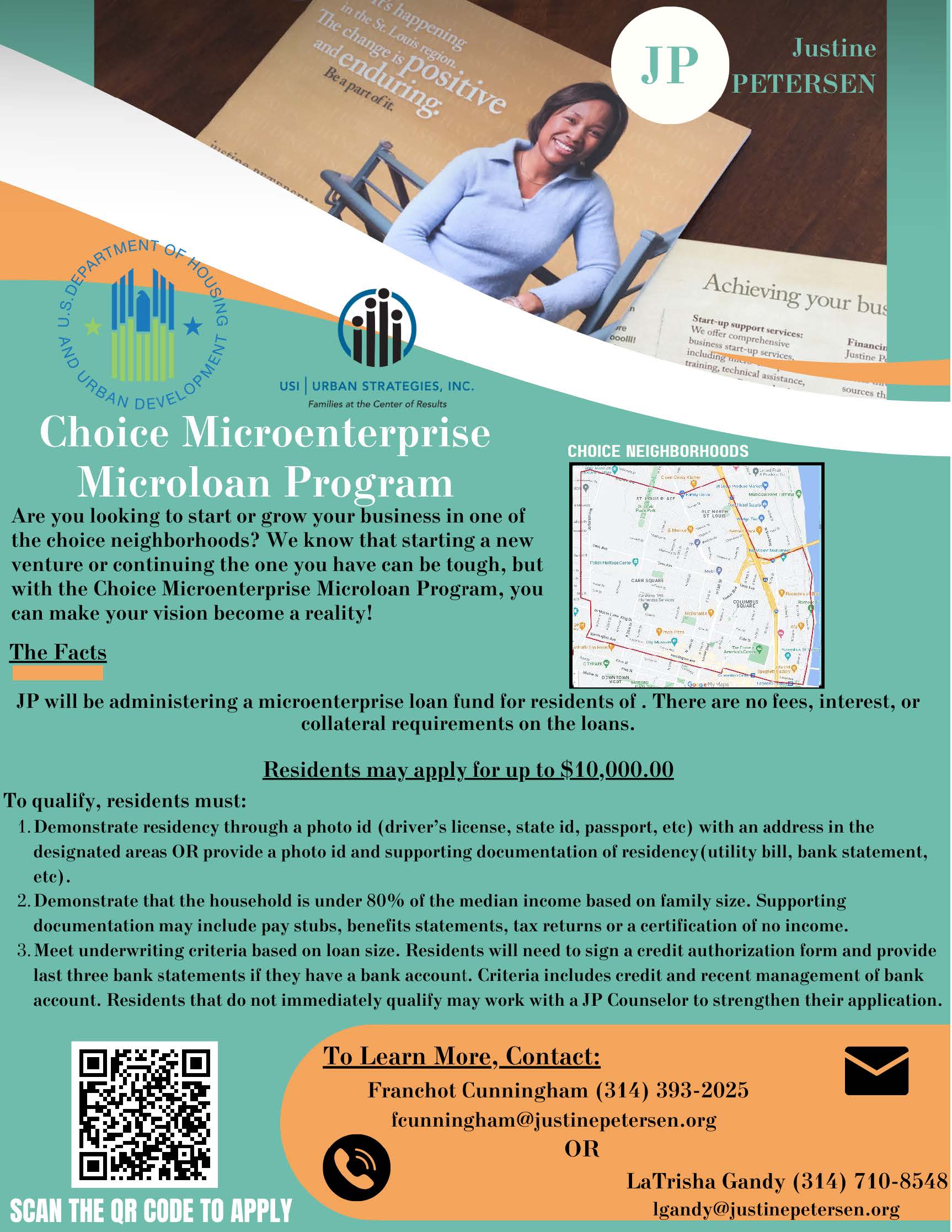

Our Choice Microenterprise Microloan Program is Here for You!

Exciting News for Small Businesses! Our Choice Neighborhood Microenterprise Microloan Program is here to empower small businesses and turn visions into reality! If you’re a budding entrepreneur looking for financial support, look no further. Let’s build a thriving community together! Apply now and let your dreams take flight.

Do You Follow Us On Social Media? Click the Icons Below to Get Started!!!

![]()

![]()

![]()

![]()

![]()

![]()

Copyright © |2020 Justine PETERSEN|, All rights reserved.

Want to change how you receive these emails?

You can update your preferences or unsubscribe from this list.

Justine Petersen Housing and Reinvestment Corporation · 1023 N Grand Blvd · Saint Louis, MO 63106-1641 · USA