Number 338 August 15th, 2025 St. Louis

Success Story: From Retail to Dive Bar – The Bold Evolution of Golden Gems and the Hidden Gem

When sisters Amanda Helman and Susan Logsdon launched Golden Gems in 2016, their mission was clear: to build a lifestyle brand that empowered people, especially women, to unapologetically take up space and live life on their terms. Hosting events, creating bold merchandise, and fostering a sense of community were all central to their vision.

But something was still missing.

They envisioned a place that combined grit, glamour, and a rebellious spirit, a dive bar that felt safe, inclusive, and undeniably cool. “The idea stemmed from a mix of craziness and big dreams,” Amanda laughs. “If the guys could do it, why couldn’t we?”

From Golden to Hidden: A Bold Leap

In 2023, their vision came to life with the launch of Hidden Gem, a dive bar unlike any other in St. Louis. Swapping out the retail focus of Golden Gems for late-night drinks, themed pop-ups, and an edgier vibe wasn’t easy. “It was a huge shift,” says Amanda, “but we believed in it.”

The Pink Pony Club, their wildly popular non-holiday pop-up, and Santa’s Speakeasy, a holiday-themed transformation, quickly put Hidden Gem on the map. The bar hosts events almost daily, from karaoke to drag trivia. Their event space can host parties and other company get-togethers. “It’s fun, immersive, and lets people be themselves,” Amanda adds.

Facing the Financial Hurdles

Like many entrepreneurs, Amanda and Susan struggled to secure traditional funding. “We had no collateral. We were working with limited assets. We almost gave up,” Amanda recalls. But thanks to a connection, a friend of a friend, they discovered Justine PETERSEN.

“Justine PETERSEN believed in us. We’re so thankful we found them. They made the process easy and accessible. Without their support, we wouldn’t be where we are today.”

Success Looks Like This

Today, Amanda and Susan are proud to say that Hidden Gem is profitable and gaining traction, with an incredible team behind them and more off-site pop-ups than ever, at music festivals, venues, and potentially in new locations. “We’ve gone from crawling to walking,” says Amanda. “We’re still here, and we’re just getting started.”

Rooted in St. Louis, Inspired by Community

Though they grew up in Florida and spent time in Greenville, Illinois, St. Louis is where Amanda and Susan chose to build their vision. “St. Louis is full of like-minded people. It’s where we’ve found community, customers, and collaborators.”

At the core of their mission is the aim to create safe and welcoming spaces, initially through retail and now through nightlife. “We want people to come in, take a deep breath, and feel like they belong. That’s the impact we strive to achieve.”

Whether they’re behind the bar at Hidden Gem or dreaming up the next wild pop-up, Amanda and Susan are proof that bold ideas, a little bit of crazy, and the right community can go a long way.

“We fight a lot, sister stuff, but growing this business together has been the best part.”

August is Black Business Month: Let’s Celebrate, Support, and Uplift

August marks National Black Business Month, a time dedicated to honoring the legacy, resilience, and impact of Black-owned businesses across the country. Black entrepreneurship has played a pivotal role in shaping the American economy since the late 19th century, and its influence remains significant today.

The movement began with leaders such as Booker T. Washington, who founded the National Negro Business League in 1900 to promote Black economic advancement. From there, thriving communities such as Tulsa’s Black Wall Street emerged as powerful symbols of Black prosperity, pride, and innovation, even in the face of adversity.

In 2004, National Black Business Month was formally established to recognize the achievements of Black entrepreneurs and to encourage investment in Black-owned businesses. It serves as a reminder of the importance of economic equity and the power of community-driven growth.

This month, we invite you to shop locally, support Black-owned businesses, and celebrate the contributions of Black entrepreneurs, past, present, and future. Whether it’s dining at a local Black-owned restaurant, hiring a Black contractor, or sharing a business on social media, your support makes a difference.

.

.

Gamers Island in Ferguson, MO

Pop Pop Hurray!

Gracious House

Upcoming Events

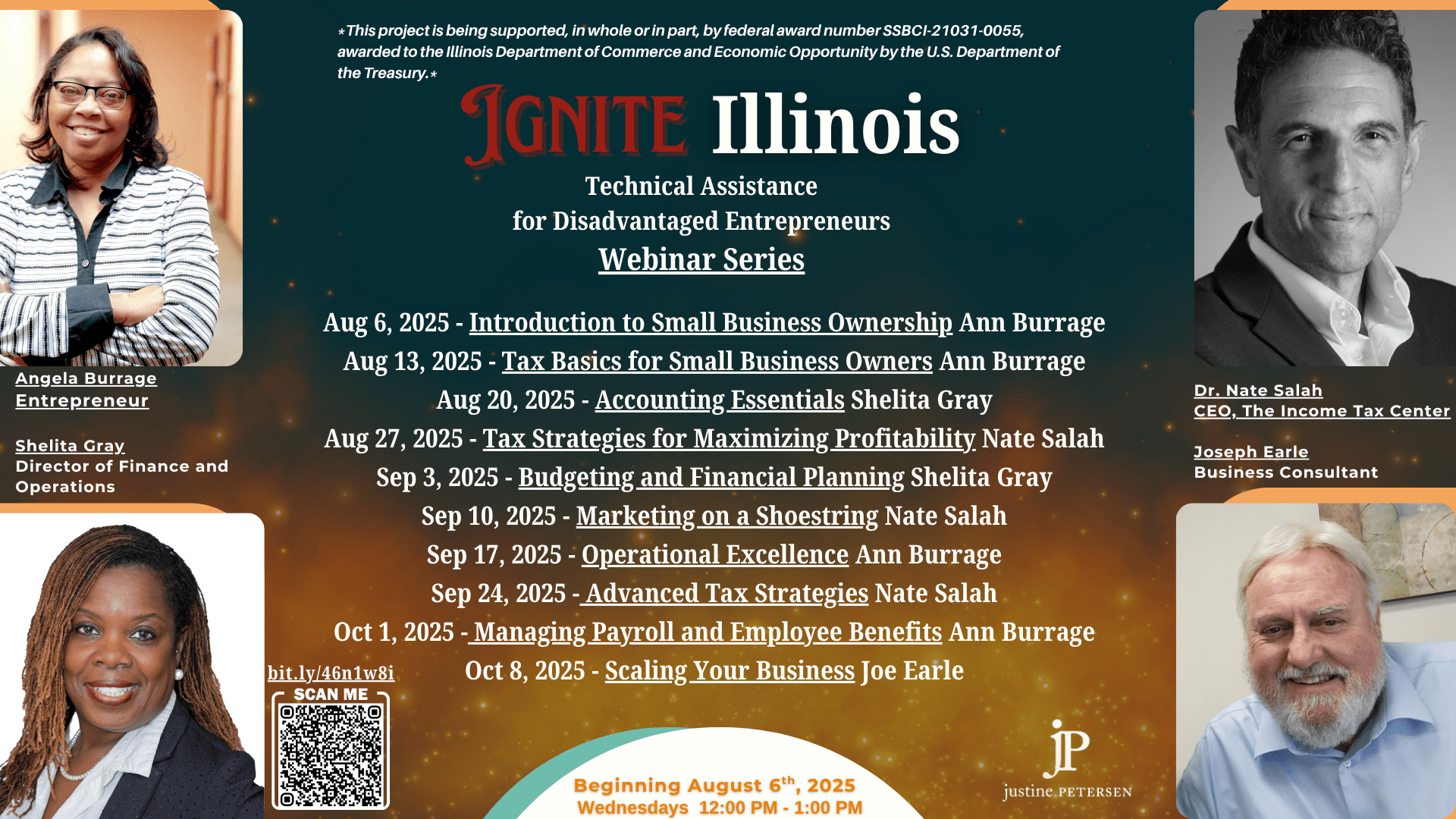

The Ignite Illinois Webinar Series is going strong

To register, go to bit.ly/46n1w8i. All are welcome!

On August 21st, Justine PETERSEN will be hosting a Legal Clinic!

See the flyer for details!

If you are interested in FREE legal advice, and you have a Small Business, contact Yolanda Nelson @ ynelson@justinepetersen.org

Happy Birthday and JPVersary!!!!

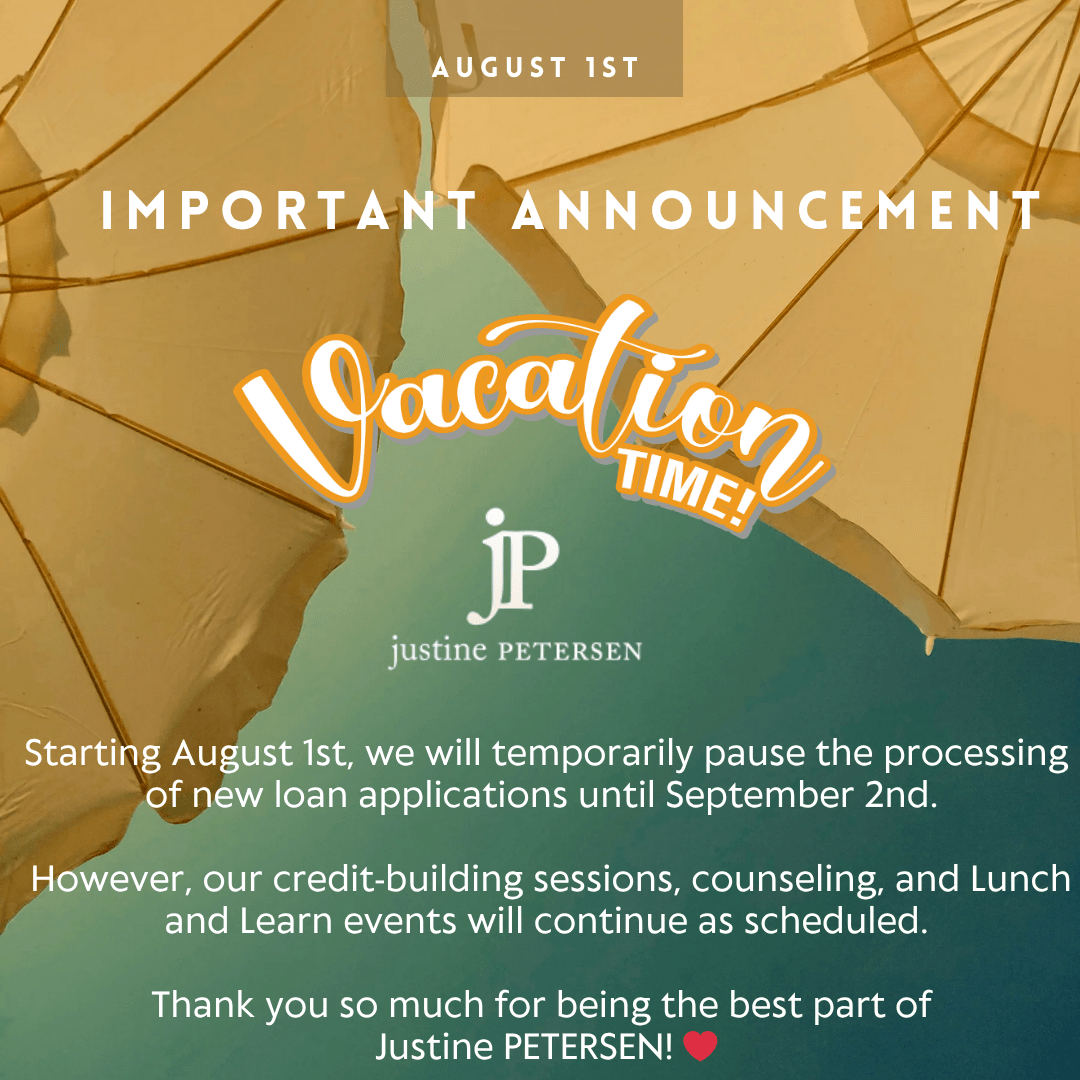

We have gone on a quick break! Looking forward to seeing you soon!

Did you know, in countries like Italy, France, Spain, and Portugal, it is common for businesses to slow down or pause operations during August?

Thank you for your patience and your inquiries. We have paused the intake of new loan applications until September 2nd. However, our credit-building sessions, counseling, and Lunch and Learn events have continued as scheduled during this time.

Thank you so much for being the best part of Justine PETERSEN!

Making Your Way to a Wonderful Financial Future!

The My Credit Compass Program is a 12-month membership designed to enhance credit awareness for entrepreneurs and help manage their FICO® Score. Through your Experian® CreditCenterTM subscription, you’ll access a dashboard to view your FICO® Score anytime without impacting it.

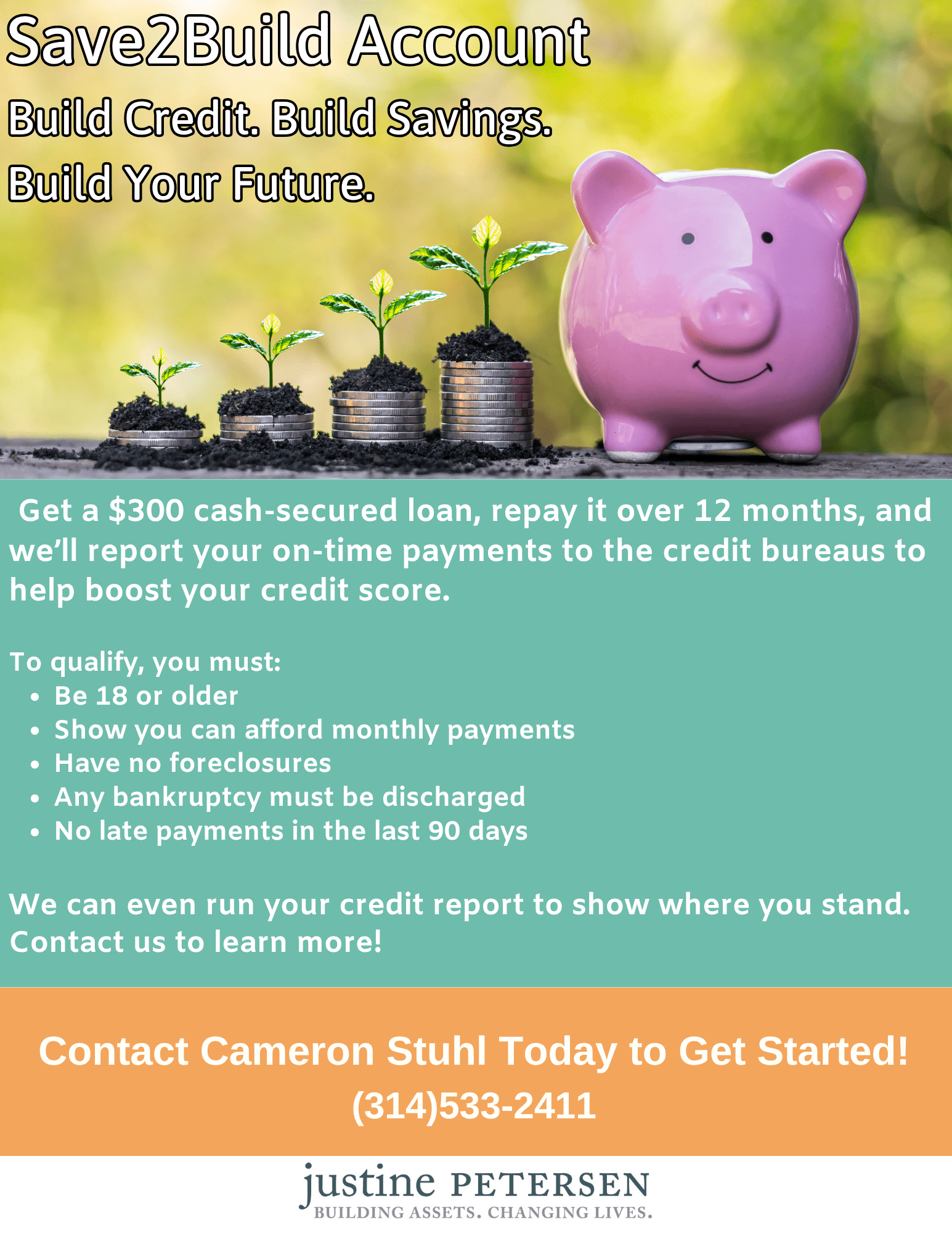

How My Credit Compass and Save2Build work together to improve your credit and help you achieve financial freedom.

While My Credit Compass provides the knowledge and tools to monitor and manage your credit, Save2Build offers a practical way to improve your credit score. Through Justine PETERSEN’s CDFI, Great Rivers Community Capital, eligible clients receive a $300 credit builder loan placed into a locked savings account. Clients repay the loan over 12 months (around $29/month), with payments reported to two credit bureaus. This repayment activity directly supports the credit monitoring and management strategies taught in My Credit Compass.

After a year, clients have not only improved their credit score but also saved $300, which can be used for financial goals like opening a secured credit card, turning credit knowledge into real financial growth.

Benefits:

- Easy-to-use technology with personal support

- Confidence from financial coaching

- Plus, much more!

We’re excited to help you on your savings journey!

Start building your credit today with My Credit Compass and Save2Build!

Do You Follow Us On Social Media? Click the Icons Below to Get Started!!!

![]()

![]()

![]()

![]()

![]()

![]()

Copyright © |2020 Justine PETERSEN|, All rights reserved.

Want to change how you receive these emails?

You can update your preferences or unsubscribe from this list.

Justine Petersen Housing and Reinvestment Corporation · 1023 N Grand Blvd · Saint Louis, MO 63106-1641 · USA