Number 277 June 7, 2024 St. Louis

North County Homeowners Initiative and Access Home Cohort Launches in St. Louis, MO

The North County Homeowners Initiative and Access Home Cohort recently launched in North County St. Louis, MO at the Refuge & Restoration Marketplace. The initiative aims to provide support and resources to aspiring homeowners in the community. This event brought together participants, community leaders, and financial experts for insightful discussions and a shared vision for the future.

The initiative saw a great turnout, demonstrating the community’s enthusiasm and commitment. Attendees enjoyed food and had the opportunity to hear from notable speakers, including representatives from U.S. Bank. Christina Dancy from U.S. Bank provided valuable insights into the home buying process and financial planning.

Among the distinguished speakers were Pastors Ken and Beverly Jenkins, long-time advocates who have been integral to the mission of the North County Innovative Center, and whose Refuge & Restoration Church and Non-profit organization plays a vital role in the re-growing area. Their inspiring words emphasized the importance of community support and collaboration in achieving homeownership dreams.

Pastors Ken and Beverly Jenkins pictured above

The Access Home Cohort, with approximately 40 members, is designed to last for ten months. Throughout the program, members will attend workshops, training sessions, and mentoring opportunities aimed at equipping them with the knowledge and tools necessary for successful homeownership.

The initiative’s primary goal is to empower North County residents by providing them with comprehensive education on home buying, financial literacy, and available resources. Participants will learn about budgeting, credit improvement, mortgage options, and other critical aspects of the homeownership journey.

As the cohort progresses, the community eagerly anticipates the positive outcomes and success stories that will undoubtedly emerge. The initiative represents a beacon of hope and opportunity, illustrating what can be achieved when individuals and organizations come together with a shared purpose.

Justine Petersen is very excited to be here in North County, and cannot wait to see what this brings to the surrounding areas.

Pride Month: Overcoming the Financial Barriers for the LGBTQIA+ Community

Pride Month is a time to celebrate the liberation and achievements of the LGBTQIA+ community, recognizing the progress made towards acceptance and equality. It commemorates the historic struggles and triumphs, shedding light on the journey from the metaphorical closet to a more open and inclusive society. Despite significant strides, the LGBTQIA+ community, particularly people of color, continues to face substantial personal and financial discrimination in 2024. This article explores the intersection of Pride Month and credit-building, highlighting the financial challenges faced by LGBTQIA+ individuals and offering strategies to overcome these barriers.

While society has become more accepting, many LGBTQIA+ individuals still encounter discrimination that affects various aspects of their lives, including their financial well-being. Studies have shown that LGBTQIA+ people, especially transgender individuals and those of color, often face higher rates of unemployment, underemployment, and wage disparities compared to their heterosexual and cisgender counterparts. These financial inequities can make it difficult to build and maintain good credit, which is essential for accessing loans, housing, and other financial services.

Good credit is crucial for financial stability and growth. It affects the ability to secure loans, rent apartments, and even obtain jobs. For the LGBTQIA+ community, credit building is not just about financial empowerment but also about overcoming systemic barriers that have historically limited their opportunities.

Challenges in Credit Building

- Economic Disparities: LGBTQIA+ individuals, particularly those of color, often earn less and face higher unemployment rates, making it harder to manage debts and build credit.

- Discrimination: Bias in the workplace and financial institutions can result in fewer opportunities and less favorable terms for loans and credit.

- Lack of Resources: Many LGBTQIA+ individuals may not have access to financial education or supportive networks that can guide them in building and maintaining good credit.

- Mental Health Impact: The stress and anxiety caused by discrimination and societal pressures can affect one’s ability to focus on financial health and planning.

Pride Month is not only a celebration of progress but also a reminder of the ongoing fight for equality. It is a time to acknowledge the financial challenges faced by LGBTQIA+ individuals and to take actionable steps toward economic empowerment. By focusing on credit building and financial education, the community can work towards breaking down the barriers that continue to hinder their financial freedom.

The President and C.E.O. of the Boeing Employee Credit Union, Beverly Anderson, said the following in “BECU CEO: ‘ Our Support for Pride Runs Deep'” out of Seattle, WA, this past year. “At BECU, we look forward to working together across the financial industry to collaborate with and celebrate the LGBTQ+ community. I look forward to the future with a focus on how we support, celebrate, and see each other.” (Anderson Hear From Our CEO)

The celebration of Pride Month underscores the importance of recognizing and addressing the unique financial challenges faced by the LGBTQIA+ community. Despite the progress made, significant barriers remain, particularly for LGBTQIA+ and BIPOC. By promoting financial education, providing access to resources, and fostering supportive networks, we can help empower LGBTQIA+ individuals to build strong credit and achieve greater financial stability. The fight for equality continues, and with it, the pursuit of economic justice for all members of the LGBTQIA+ community.

Small Business Legal Clinic! June 20th, 2024

Searching for legal guidance tailored to your business needs? Look no further! Our highly anticipated Legal Clinic for this month is officially open for signups!

Act fast, as spots are LIMITED! Only six entrepreneurs will have the chance to secure their spot. Don’t miss out on this golden opportunity to get expert advice and support for your small business journey!

For inquiries, reach out to Marcus Bolden at mbolden@justinepetersen.org.

If you are ready to sign up, click here.

Juneteenth Run: Race For Reconciliation!

Join us at the Delmar Loop for an unforgettable Juneteenth Celebration on June 15th! Celebrate freedom and community with us as University City and St. Louis City come together, alongside Delmar Main Street and the St. Louis Reconciliation Network. Enjoy a 5K morning run, an afternoon vendor fair, and an evening celebration with African dancers, drummers, musicians, and a car show. Don’t miss this vibrant festival of unity and diversity!

To learn more and to sign up for the event, click here The Delmar Loop.

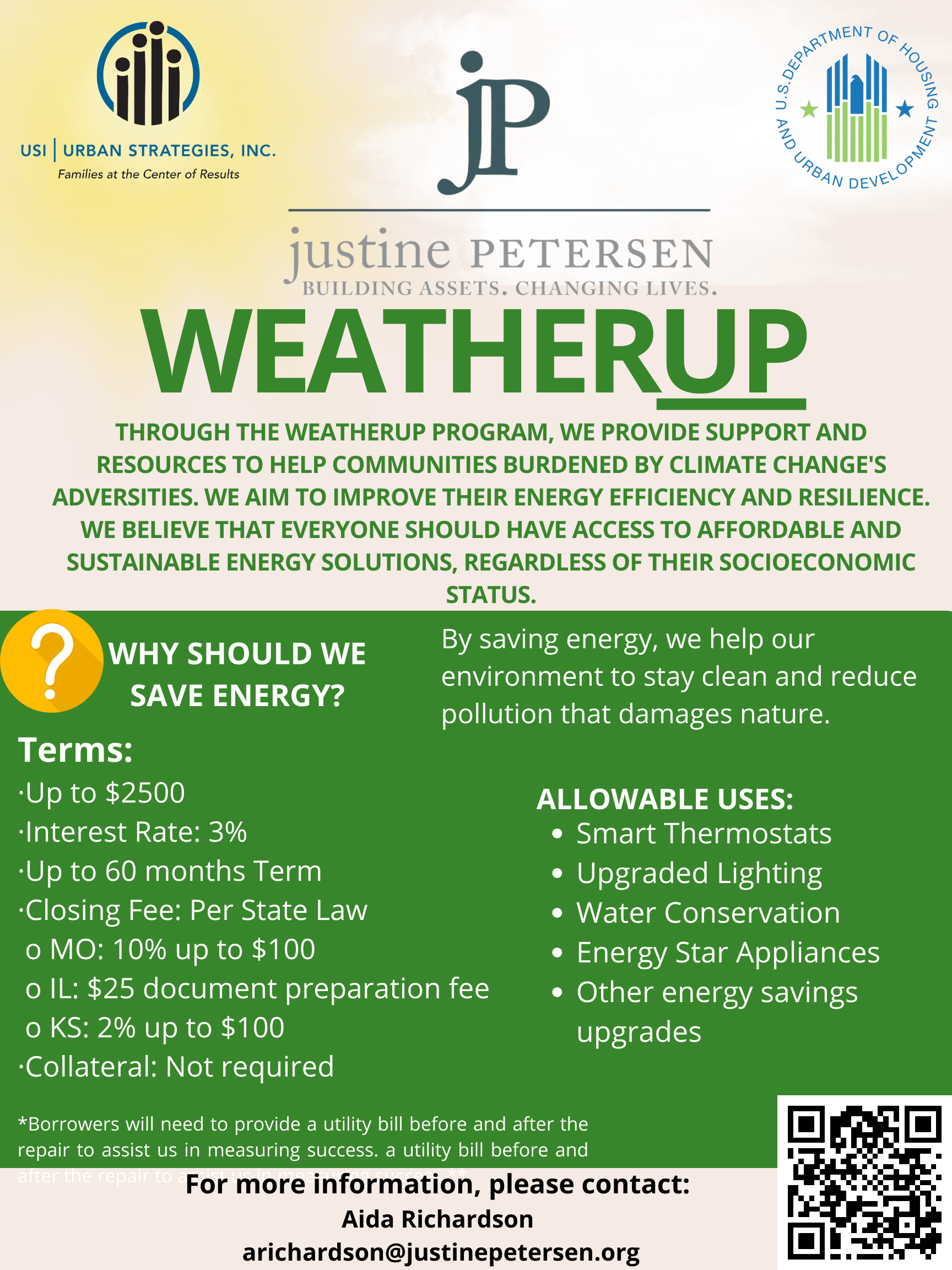

The WeatherUP Loan is Here for You!

With our WeatherUp Loan program, you can begin transforming your home into an eco-friendly haven, contributing to a brighter future for everyone in your community. Discover more details below for a sustainable and impactful initiative.

Click here to begin your application today!

Do You Follow Us On Social Media? Click the Icons Below to Get Started!!!

![]()

![]()

![]()

![]()

![]()

![]()

Copyright © |2020 Justine PETERSEN|, All rights reserved.

Want to change how you receive these emails?

You can update your preferences or unsubscribe from this list.

Justine Petersen Housing and Reinvestment Corporation · 1023 N Grand Blvd · Saint Louis, MO 63106-1641 · USA