Number 270 April 19, 2024 St. Louis

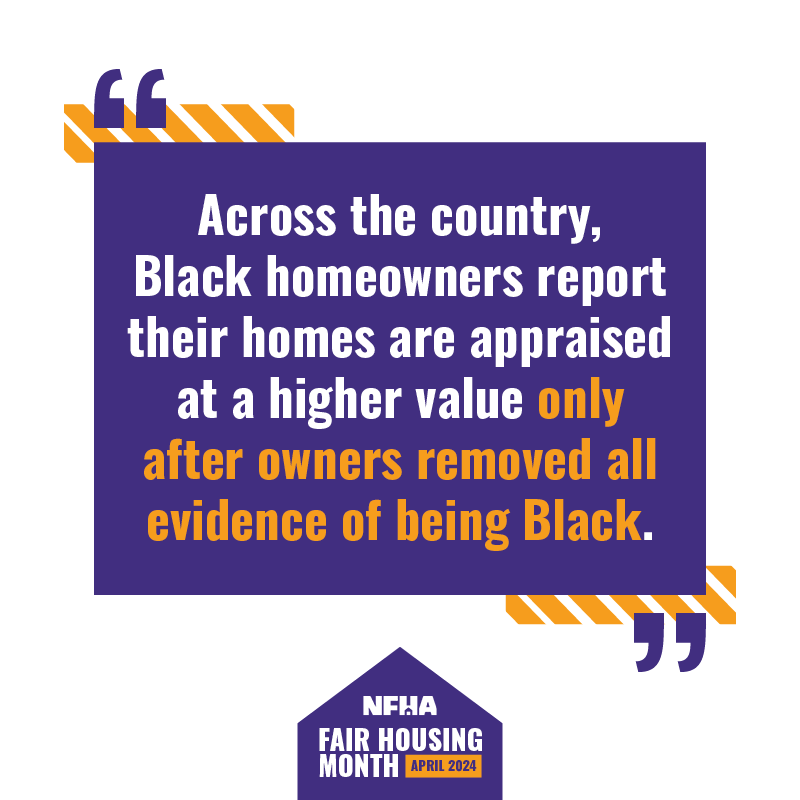

April is National Fair Housing Month!!

This week, our focus is brought to Appraisal Bias

Photo courtesy of National Fair Housing Alliance

Unveiling Appraisal Bias: A Lingering Challenge in Housing Equity

In the realm of real estate, the appraisal process stands as a critical determinant of property value. However, beneath the surface of this seemingly objective procedure lies a pervasive issue: appraisal bias. This insidious form of discrimination can manifest in various ways, from conscious prejudice to subconscious biases and the enduring ramifications of historical injustices.

At its core, appraisal bias occurs when the value of a property is unfairly influenced by factors unrelated to its inherent qualities. One of the most glaring examples is the devaluation of homes based on the race of the occupants. This form of discrimination not only undermines the principles of fairness and equality but perpetuates systemic inequalities that have deep roots in history. (1)

For many BIPOC (Black, Indigenous, and People of Color) individuals, appraisal bias is a harsh reality that directly impacts their ability to secure fair valuations for their homes. Despite advancements in civil rights and fair housing laws, the lingering effects of historical discrimination continue to cast a shadow over the appraisal process.

In response to this injustice, organizations like the National Fair Housing Alliance (NFHA) have been at the forefront of advocacy efforts, tirelessly fighting to eradicate appraisal bias and promote housing equity. One of the strategies employed by BIPOC homeowners to circumvent appraisal bias is to obscure indicators of their racial identity during the appraisal process, a saddening testament to the lengths individuals must go to attain fair treatment.

The battle against appraisal bias is not merely a matter of correcting numerical discrepancies in property valuations but addressing deeper societal inequities. It calls for a concerted effort to dismantle systemic prejudices, challenge implicit biases, and ensure that the principles of fairness and justice are upheld in every facet of the housing market.

As we continue to strive towards a more inclusive and equitable society, it is imperative that we confront and rectify the injustices embedded within the appraisal process. Only by acknowledging and actively combating appraisal bias can we move closer to realizing the promise of fair and equal treatment for all individuals, regardless of race, creed, or background.

For further reading, head to Appraisal Bias Undervalues Homes and Robs Homeowners of Equity – Here’s How To Spot It.

1. Grace, Molly. “Appraisal bias undervalues homes and robs homeowners of equity — here’s how to spot it” 28 Dec. 2023, www.businessinsider.com/personal-finance/appraisal-bias. Accessed 19 Apr. 2024.

2. “Appraisal Bias” NFHA, nationalfairhousing.org/issue/issue-appraisal-bias/. Accessed 19 Apr. 2024.

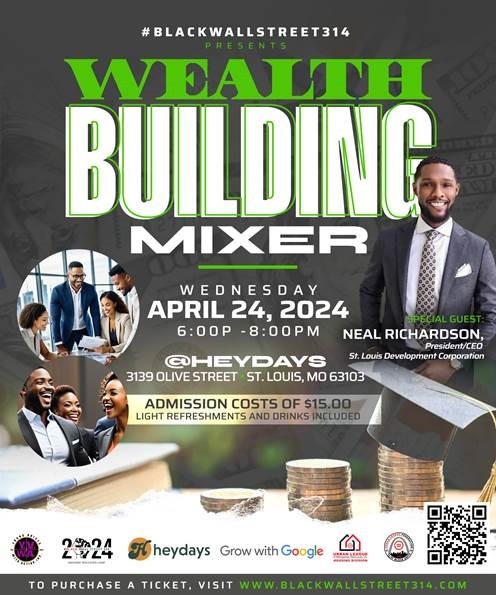

Local Events: Wealth Building Mixer

The Wealth Building Mixer is next week on Wednesday April 24 at 6:00pm. Tickets are still available! Purchase your ticket today at www.blackwallstreet314.com for ONLY $15.

We invite your organization to join us and help the Federation of Block Units and #BlackWallStreet314 connect with entrepreneurs, homeowners and those seeking to become that. Our special guest will include Neal Richardson, CEO of St. Louis Development Corporation to provide updates to the Economic Justice Plan and wealth building opportunities in the City of St. Louis.

Each represented financial institution and resource provider will have a chance to introduce their services and products. If you have resources and connections you seek to make or share, we welcome your participation and attendance.

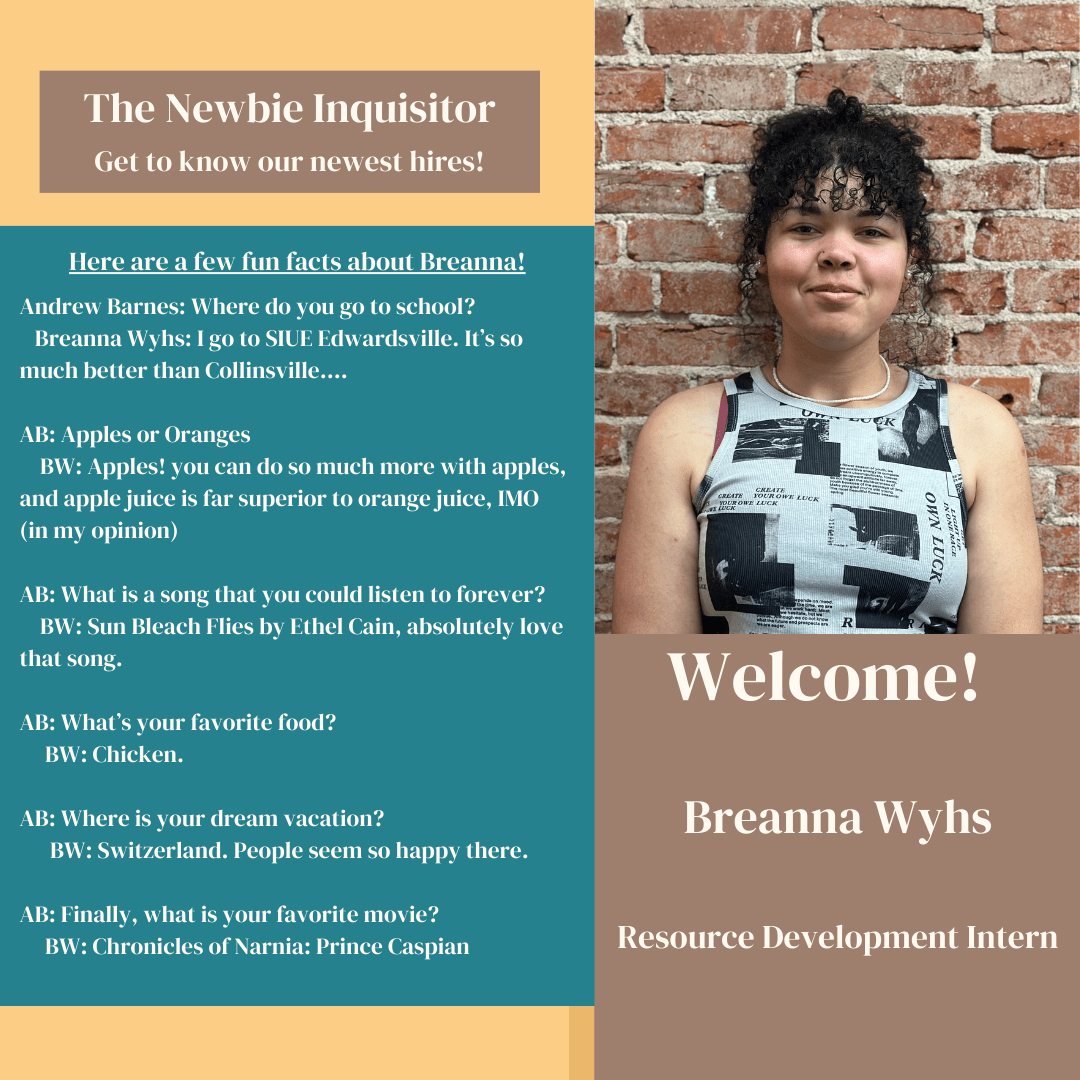

Introducing Our Newest Segment: The Newbie Inquisitor!

Ever wondered what goes on in the minds of our latest additions to the team? Curious about their hobbies, hidden talents, or favorite office snacks? Well, wonder no more! In this exciting new segment, we delve into the lives of our newest team members, asking the burning questions and uncovering the fascinating stories behind the fresh faces in our midst.

Join us as we embark on a journey of discovery, welcoming our newcomers with open arms and getting to know the unique personalities that make our team shine. Get ready to be entertained, inspired, and maybe even surprised as we shine a spotlight on the stars of tomorrow in “The Newbie Inquisitor”!

Microloan Microphone with Tristan Brown!

Where empowerment echoes through every conversation.

Join host Tristan Brown as he delves into the transformative power of microloans, amplifying the voices of individuals who have utilized these funds to kickstart or propel their small businesses forward. Through enlightening discussions, we explore how these modest yet mighty financial tools fuel dreams, foster innovation, and empower entrepreneurs to seize opportunities and carve their paths to success. Tune in as we unravel inspiring stories of resilience, creativity, and triumph, showcasing the profound impact that microloans wield in fostering economic empowerment and fostering vibrant communities worldwide.

New episodes will be uploaded every other week. Check out the current episodes at @JustinePetersen on YouTube!

Early Giving for Give STL Day Begins April 24th!

Make sure you seize this opportunity to donate to your preferred nonprofit a few days ahead of time! Every $50 goes to enhancing our credit-building program, which enriches our community. Early giving is two weeks long and it will take place just before midnight April 24—11:59:59 p.m.

Click here to start donating today!

![]()

![]()

![]()

![]()

![]()

![]()

Copyright © |2020 Justine PETERSEN|, All rights reserved.

Want to change how you receive these emails?

You can update your preferences or unsubscribe from this list.

Justine Petersen Housing and Reinvestment Corporation · 1023 N Grand Blvd · Saint Louis, MO 63106-1641 · USA